Resilient

Systems

Capital

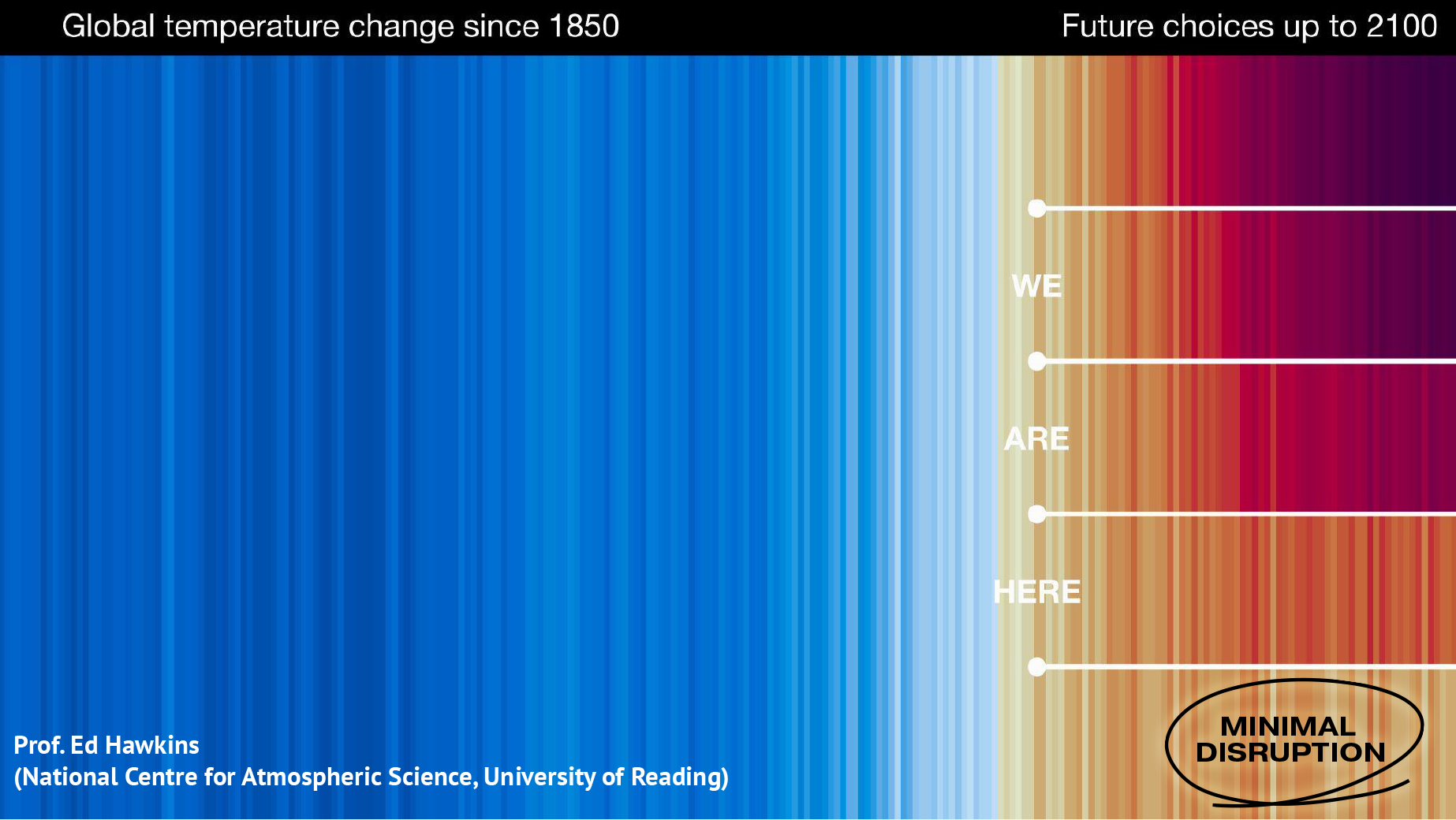

1990s: Climate Change

2030s: Resilience

The difference? Policy won’t drive demand—nature will.

Resilience is climate tech in the era of climate consequence.

Thematic Thesis

-

EXPONENTIAL ENERGY

Building clean energy infrastructure and networks is non-optional. It is hard to overstate the economic opportunity associated with the growth of the energy sector through the 2030s.

-

RESILIENT SYSTEMS

Hardier crop varieties currently cost $100M+ each; wildfire losses are 2-4% of the US GDP; the depth of human systems toxicity is just starting to be understood; resilient investment is 6x cheaper than cleaning up.

-

INFRASTRUCTURE AI

AI that helps us measure & rebuild the world. From robotic automation to bio-manufacturing to planetary intelligence, AI is the definition of better, faster, cheaper.

WHAT WE INVEST IN

FOUNDERS WITH GRIT, AUDACITY, AND INTEGRITY, BUILDING COMPANIES AROUND:

ENERGY SYSTEMS

Deliver reliable power through innovations in generation, storage, T&D, and security.

Efficiency, efficiency, efficiency for industrial manufacturing - to reduce waste and streamline processes.

INDUSTRIAL EFFICIENCY

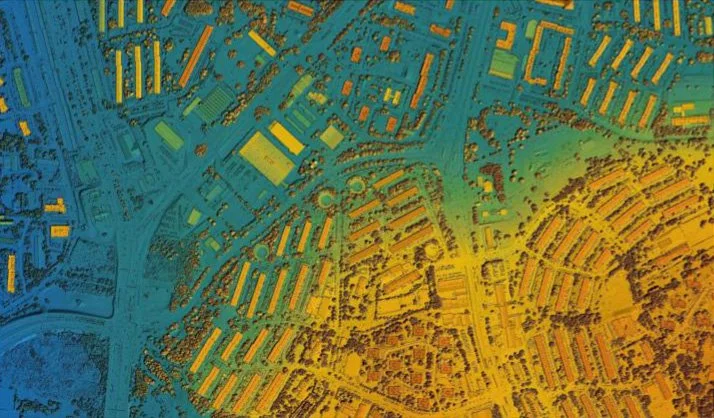

INFRASTRUCTURE RESILIENCE

Technology that enables supply chains to stay online and rebound quicker from disruption.

INTELLIGENT OPERATIONS

Automating consultants. Processing planetary datasets. Defensible decision-making.

BIO-INDUSTRIAL SOLUTIONS

Replace conventional inputs with efficient, biology-driven processes and materials.

DETOXIFICATION & RECOVERY

Identify, remove, and remediate toxins from planetary & human systems.

Team

General Partner

SUNDEEP AHUJA

-

Sundeep previously founded Climate Capital, one of the most active early stage climate investors in the world. He's been in climate for 15 years and in tech for 25 years. Prior to becoming an investor he co-founded 3 companies (all exits).

He is a graduate of Stanford University and lives in Berkeley, CA.

IAN CAMPBELL

Founding Principal

-

Ian brings to RSC 5+ years of early-stage climate and energy investment on teams at MassCEC and Climate Capital. Previously, he drove research & adoption of technology for farmer profitability in both Ghana (Farmerline) and the US (Indigo).

He is a graduate of Northeastern University and lives in Seattle, WA.